The Human Rights of Investors in EEA Life Settlements were unlawfully restricted by the Financial Services Authority. The following document sets out the specific violations of the Human Rights Act (1998).

Definitions

EEA: EEA Life Settlements Limited and associated companies

FCA: Financial Services Authority (FSA), Financial Conduct Authority (FCA), UK financial services industry regulator

TPLIs: Life Settlement Funds

EEA

EEA Fund Management Limited was registered in England in 2003 (number 0472946) and has been regulated by the FSA (number 438417) since then. The EEA Life Settlement Fund PCC Limited was established in 2005 and advertised as “A Low Risk, Uncorrelated lnvestment Solution” regulated in the Channel Island of Guernsey by the Guernsey Financial Services Commission (GFSC). From the inception of the fund in 2005 until its suspension in 2011 it was audited by Ernst and Young. Other key partners were as follows; ViaSource Funding Group (investment adviser), Kleinwort Benson (Custodian), Bank of New York Mellon (trustee and escrow agent), and BNY Asset Solutions a division of the Bank of New York (secondary asset servicer and verifier of all policies). (See Brochure*4)

The investment offered the opportunity to invest in life policies that had been purchased in the USA from people who became terminally ill after taking out their policies. With limited life expectancy, they were unable to cash in their policies for more than a derisory amount offered by their insurers. The EEA proposition was to pay a significantly higher amount, enabling an improvement in the quality of the remaining years of life or enhanced health care. In doing so, EEA would continue to pay all remaining installments into the policy until the original beneficiary passed away, at which point the maturity value would be paid to EEA. Many investors saw this as a highly ethical fund, which, until its suspension at the end of 2011, had consistently returned an apparent 8% – 12% on investments each year as predicted in its business plan. Given the reputation of the auditors there was no reason to doubt the accuracy of the published results.

As the FSA had regulated the UK operation since inception and the GFSC had regulated the Guernsey business, EEA appeared to have significant credentials as a low risk investment vehicle.

The FSA Announcement

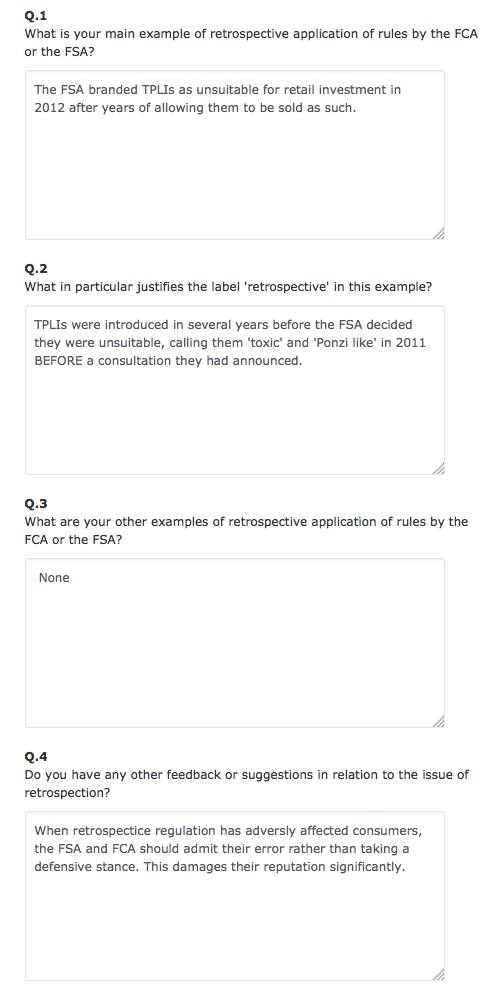

At some point prior to November 2011 the FSA formed the view that the class of investment offered by EEA and other such companies represented a risk to ordinary savers. By this time more than a billion pounds had been invested and no indication of such concerns had been communicated to ordinary savers. In order to act upon their concerns, the FSA decided to announce a consultation process. Unbeknown to anyone outside the FSA, the consultation process would be announced by way of a publication that declared Life Settlement Funds to be ‘toxic’, ‘Ponzi like’ and unsuitable for retail investors. In subsequent publications they also referred to such funds as ‘Death Bonds’.

Prior to making this announcement a so-called ‘cost benefit analysis’ was conducted within the FSA. This failed to provide detailed costs, the value of any benefits, or a clear risk assessment but did acknowledge the following: “There is a risk that publishing the guidance may lead to a run and, if that jeopardises the viability of the product, consumers may lose money as a result.” An average of £36,000 per investor was found with one provider and they estimated the UK market alone to worth around £1 billion. (*5 Cost Benefit Analysis)

It was clear the FSA held concerns, which may or may not have been valid but there was a lack of balance between the interests of existing and potential future investors. The magnitude of existing investments was known but no estimate was given to the value of those that might have occurred in the future. Clearly this would depend upon whatever strategy was employed to limit future investments. It was also clear that the impact of their announcement might damage funds thereby creating a self-fulfilling prophecy.

In order to minimise the impact on existing investors, the FSA had a responsibility to explore all alternatives to making an announcement, which they predicted would result in losses for existing investors. A request was made under the Freedom of Information Act to ascertain what alternatives were considered. The response from the FSA follows.

Freedom of Information : Right to know request FOI3351

We refer to your clarified request under the Freedom of Information Act 2000 (the Act) for the following information.

“Please could you forward copies of any internal documentation that describes the processes, meeting minutes and especially the risk assessment leading up to the announcement made in November 2011 by then managing director Margaret Cole when she stated that traded life settlements are toxic products which had caused significant consumer detriment.

Also

Details of the alternative courses of action that were considered to that of making an announcement in which language known to be pejorative and inflammatory was used. For clarity I am not simply asking for information that demonstrates a consideration of whether or not alternatives to a statement were considered, although I would like to know what these are. I would especially like to understand the alternatives that were considered, if any, to issuing a statement that included such language.”

Your request has now been considered. However, I am sorry to inform you that we estimate that to comply with your request in full would exceed the 18 hour time limit. The information requested is likely to be spread across a large number of documents and in order to ascertain whether we hold information relevant to your request we would need to review and assess all of the documents to retrieve the information relevant to your request, and therefore the following exemption applies. • Section 12 (Costs of compliance exceeds appropriate limit)

Given the availability of documentation relating to all other aspects of this announcement, standards of record keeping and filing procedures that might be expected of a regulator’s office, the known impact, and the obligation to demonstrate the validity of their actions, it seems likely that no alternatives were considered to the announcement that was eventually made in November 2011. (*6 Announcement) (*7 Guidance Consultation)

Immediately following the announcement EEA faced an unprecedented and unsustainable run on redemption requests that resulted in the suspension of the fund.

Given the impact on various funds it cannot be known for certain how well or badly things would have gone if the FSA hadn’t intervened. But it is disturbing that funds that operated over several years during which they were regularly audited and subject to the regulatory regime, were not identified as a potential risk earlier and no auditors have yet faced legal action over the professionalism of their audits, including valuations. However, this case is not about the operation of firms such as EEA or the efficacy of the regulator taking appropriate action over concerns however well founded or misguided. The case is that regulator unlawfully restricted the human rights of existing savers.

Human Rights Act (1998)

The FSA was a public authority responsible to central government, an executive agency and a statutory regulatory body. As such it was and is covered by the Human Rights Act. (*1, page 14) (*2, page 60) (*3, page 8)

Investors, as citizens are embraced by the Human Rights Act regardless of nationality or citizenship. (*1, page 2)

Article 1 of Protocol 1 of the Human Rights Act states that a person has the right to the peaceful enjoyment of their possessions. (*1, page 9) including money, shares, etc. (*2, page 45)

Public authorities are obliged to take action to preserve the above right to the peaceful enjoyment of possessions when contemplating any action that may restrict that right. (*2, page 45) As a qualified right, there are circumstances under which it may be legitimate for a public authority to restrict this right. However, certain safeguards must be observed including:

1) The principle of proportionality states that ‘a sledgehammer must not be used to crack a nut’.

The FSA was obliged to interfere as little as possible and only go as far was necessary to achieve their objective. In using inflammatory and inaccurate language to describe Life Settlement funds, the FSA deliberately utilised a linguistic ‘sledgehammer’ when more measured and accurate terminology would have sufficed. (*2, pages 6 & 51)

2) There is no evidence that the FSA explored less restrictive alternatives to their announcement and no alternatives were tried, contrary to Department of Justice guidelines. (*2, page 58) (*3, page 22)

One such alternative would have been the omission of inflammatory and inaccurate language from their announcement. The FSA have subsequently acknowledged that their use of the term ‘toxic assets’ may have led to some confusion for some customers, that some respondents felt the term ‘death bonds’ was emotionally charged, and that they did not mean they had found some fund providers were Ponzi schemes nor are they alleging this. Whilst promising to update the wording of guidance on this point to clarify their meaning, they have since used the language on several occasions including an ITV television news statement. (*8, page 4) (*9 FCA ITV)

Another alternative would have been to impose restrictions on selling to new clients until the consultation concluded, thus achieving their objective whilst safeguarding existing investors. A further alternative would have been to conduct discreet investigations into those funds about which they held suspicions so that they could distinguish between the problem funds and those, which met their requirements of best practice. There were clearly several less damaging alternatives that were neither considered nor attempted before launching what they knew would be a damaging announcement.

3) There was no communication from the FSA to ensure those to whom their restriction applied could find out about it. As such there was no legal basis for their restriction. (*2, page 54)

It was suggested by the Complaints Commissioner (Sir Anthony Holland) that a number of fund providers did not object to the announcement before it was published. Following enquiries under the Freedom of Information Act, it now appears that the FSA did not pre-consult on the wording of the announcement and the impression of consensus suggested by the commissioner was deliberately misleading. In fact the consultation feedback clearly showed that providers did not agree with the language used. (*8, page 1) Further, the same enquiry revealed that only a very small number of providers were in communication with the FSA prior to their announcement and the FSA has no records of correspondence with other regulators or bodies which would demonstrate prior warning about the wording of their announcement, neither was there any attempt to warn existing investors.

4) Article 6 of the Human Rights Act requires all public authorities to provide the right to a fair hearing. However, under an exemption in the Financial Services and Marketing Act 2000, the FSA will not accept any complaints (even for misconduct) relating to its legislative functions and therefore denies this right. Several complaints have been attempted and rejected on these grounds.

Remedy

If, in the common good, it had been reasonable to restrict the qualified human rights of these investors, they should have been compensated. In the same way that property owners, who suffer compulsory purchase to enable road building or other deemed necessary infrastructure, are paid compensation, so should investors who have sacrificed their savings to protect future investors from a perceived threat. (*2, page 44)

Despite the damage done to the investment class and continued lack of access to investments, the underlying assets of EEA retain some value several years after the suspension. Whilst this suggests that the scheme could not justifiably have been labeled ‘Ponzi like’ (which would have collapsed through a lack of new sales) or based upon ‘toxic assets’ (which have very significantly reduced after market value), it does nothing for those who have relied upon an income or capital growth from their investment. As the basis of this claim is an unlawful restriction of human rights, individual and corporate exemption from liability is forfeit. Damages should therefore be paid in addition to any settlement based upon the capital value of investments at the time of the suspension.

Sources (referenced by * in text)

Ministry of Justice Publications

- Making Sense of Human Rights – A Short Introduction (Ref. DCA 45/06 Copyright October 2006)

- Human Rights, Human Lives – A Handbook for Public Authorities (Ref. DCA 55/06 Copyright October 2006)

- The Human Rights Framework as a Tool for Regulators and Inspectors

Other

- EEA Brochure

- FSA Cost Benefit Analysis

- FSA Announcement FSA/PN/102/2011 28 Nov 2011

- FSA Guidance Consultation

- Summary of Feedback from Consultation

- FCA on ITV